Tax Cuts in House Budget Bill: Everything You Should Know

Introduction

The dialogue around tax cuts in the House price range bill has received predominant traction in recent months. As lawmakers intend to stimulate the economic system and ease the financial burden on citizens and corporations, these proposed tax modifications are massive. Whether you are an enterprise proprietor, salaried employee, or retiree, understanding how the House budget invoice’s tax cuts should affect you is important. In this text, we break down the modern traits, who blessings, potential criticisms, and what to anticipate subsequent.

| Section | Details |

| Title | Tax Cuts in House Budget Bill: Everything You Should Know |

| Primary Keyword | Tax Cuts in House Budget Bill |

| High Priority Topics | Key Provisions, Impact on Individuals and Businesses, Criticisms, Future Outlook |

Overview of the House Budget Bill

The House finances bill is a comprehensive file that outlines federal spending, taxation, and monetary priorities for the approaching 12 months. This year’s invoice prominently capabilities massive tax cuts aimed at:

- Stimulating monetary boom

- Easing inflation pressures

- Supporting center-magnificence families and small groups

Key Provisions: Tax Cuts in House Budget Bill

Individual Income Tax Reductions

- Lowered fees for center and lower-profits brackets.

- Increased standard deduction to provide on the spot tax remedy.

- Expansion of the Earned Income Tax Credit (EITC).

Corporate Tax Revisions

- Corporate tax charge decreased from 21% to 19% for qualifying small organizations.

- Introduction of brief deductions for investments in infrastructure and green energy.

Child and Family Tax Benefits

- Increase in the Child Tax Credit up to $3,600 in line with infants.

- Creation of a new own family caregiver tax credit.

Capital Gains and Investment Incentives

- Preferential tax remedy for long-time period investments.

- Expansion of Opportunity Zones to force network investments.

Who Benefits from These Tax Cuts?

| Category | Benefits |

| Middle-Class Families | Lower tax rates, larger deductions, higher child tax credits. |

| Small Businesses | Reduced corporate tax rates and deductions for infrastructure investment. |

| Retirees | Expanded income exemptions for social security benefits. |

| Investors | Favorable long-term capital gains rates. |

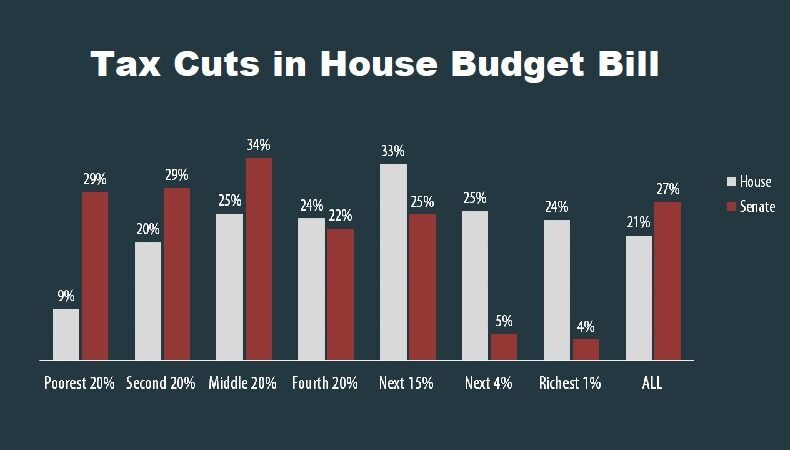

Important: High-income earners see fewer advantages in comparison to center and lower-income agencies.

Projected Economic Impact

- GDP Growth: Economists are expecting a 0.5% to at least 1% growth in GDP over the following financial year.

- Job Creation: Enhanced deductions should stimulate hiring amongst small to medium firms (SMEs).

- Consumer Spending: Higher disposable incomes might also improve retail and carrier sector increase.

However, a few professionals warn about increasing the federal deficit.

Criticisms of the Tax Cuts in House Budget Bill

Increase in Federal Deficit

Critics argue that:

- Reduced tax sales should add $200 billion to the deficit over 10 years.

- There are not any matching spending cuts to offset the misplaced revenue.

Benefits Skewed Toward the Wealthy

Although centered on the middle class, critics claim that:

- Some tax incentives, particularly for investments, disproportionately prefer better-earnings individuals.

Temporary Nature of Cuts

- Many cuts, specifically corporate benefits, are set to expire inside five-7 years until renewed.

Comparison to Previous Tax Reforms

| Reform | Key Differences |

| Tax Cuts and Jobs Act (2017) | Focused more on corporate tax cuts and deregulation. |

| House Budget Bill (2024) | Emphasizes middle-class relief and green investment incentives |

.

The modern-day invoice is greater socially balanced but nonetheless faces comparable criticisms concerning deficit issues.

What Experts Are Saying

- Supporters: Argue the cuts are important to counter inflation and global economic slowdowns.

- Opponents: Warn that without sales-elevating measures, these cuts will significantly strain countrywide debt tiers.

Prominent economists like Dr. Angela Fairchild and Prof. Mark Stevenson have presented mixed opinions, stressing the want for a balanced monetary technique.

Future Outlook: Will These Tax Cuts Last?

| Possibility | Explanation |

| Extension by Congress | If the economy improves, Congress might make the cuts permanent. |

| Repeal by Future Administrations | A change in political leadership could reverse or amend provisions. |

| Modification | Adjustments could occur depending on the fiscal health of the nation. |

Important: Political trends in upcoming elections ought to heavily have an effect on the future of these tax cuts.

How to Prepare for the Changes

- Consult a Tax Professional: Review how the modifications affect your personal or enterprise budget.

- Adjust Withholdings: Ensure correct tax withholdings to maximise benefits.

- Plan Investments: Take gain of new investment tax breaks early.

- Stay Updated: Monitor changes, specially around sunset clauses.

Smart monetary making plans assist you to maximize the blessings of the brand new tax shape.

FAQs About Tax Cuts in House Budget Bill

Q1. What is the number one intention of the tax cuts within the House budget invoice?

The aim is to stimulate monetary increase and provide financial comfort to middle-magnificence families and small companies.

Q2. Who benefits the maximum from these tax cuts?

Middle-magnificence households, small enterprise proprietors, retirees, and lengthy-time period traders.

Q3. Will the tax cuts grow the federal deficit?

Yes, projections advise an addition of approximately $two hundred billion over a decade.

Q4. Are these tax cuts everlasting?

No, many cuts are brief and a problem to renewal primarily based on destiny congressional movements.

Q5. How does this bill vary from the 2017 Tax Cuts and Jobs Act?

The 2024 invoice is more focused on character remedy and funding in inexperienced infrastructure.

Q6. Are high-income earners getting full-size advantages?

Not as a whole lot; the bill is designed to favor middle and decrease-profits companies.

Q7. What do people and organizations do now?

Review tax strategies, consult professionals, and align financial plans with the brand new laws.

Summary

The tax cuts in the House budget invoice provide vast economic blessings for center-class households, small corporations, and investors while aiming to stimulate economic growth. However, worries about the federal deficit and the brief nature of these cuts remain massive points of debate. Staying informed and proactive can assist people and organizations navigate those modifications efficiently.

Disclaimer: This article is for informational purposes only and does no longer constitute prison, monetary, or tax recommendation. Readers are recommended to seek advice from licensed professionals concerning their unique tax situations. All legislative info is a problem to exchange primarily based on future authorities movements.

You may also like

Archives

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

Leave a Reply